2018-11-28

![]()

Author: Eric (Tianli) Wen, Head of Research

For past Pilgrimage publications, please contact BLRI sales (sales@blue-lotus.cn).

| Stocks mentioned in this email | None |

Dear all:

Presidents Xi and Trump will meet at the G20 Summit this Friday in Buenos Aires. Many has expected the two to reach a cease-fire. We disagree. We don’t know what fire are they going to cease. Made-in-China-2025? I don’t think that is possible. Suspending Made-In-China-2025 is like saying surrendering your weapons and we will be good friends. The problem is if I surrender my weapons we can never be friends. Trade tariffs? To my understanding trade tariff is a way to exact pain on the other side. Now the level of pain on China is greater than that on US. Why should the US give up?

So my take is that this weekend the summit is going to fail. The reason is President Xi is not willing to make false promises that China will rein in its support of the high tech industry with state funding. Many in China expect him to make such promises but they avoid the hard question whether China intends to make good on this promise. Their logic is that if China has made so many false promises why can’t it make it again? This doesn’t sound like a question to us. The logic is like if you have been a bad guy in the past, why can’t you evade punishment by promising you will never do bad things again. The problem is if one is at the position to make such a statement, he will not be in the punishing box in the first place.

How do I know President Xi is not willing to make false promises? Nothing is clearer than the outcome of the just-concluded APEC Summit in Papua New Guinea. China and US were head to head on Belt-and-Road and foreign aid. Now maybe the US side were posturing, but APEC also made it bare that China has not intended to back off exporting its influences, which we believe is the real reason that US will not back off from its influences.

How about the US dropping the next round of tariffs in exchange for China making a false promise of stopping Made in China 2025? That is wishful thinking in my opinion. Just now China is rolling out its Science and Technology Board, a special section in Shanghai Stock Exchange that will allow mutual funds to invest in early stage technology startups. It shows President Xi has no intention to back off from his desire to marshal state resources to promote science and technology at this critical juncture of technology curve for the mankind. How does China make believe it is giving up Made-In-China-2025 for good?

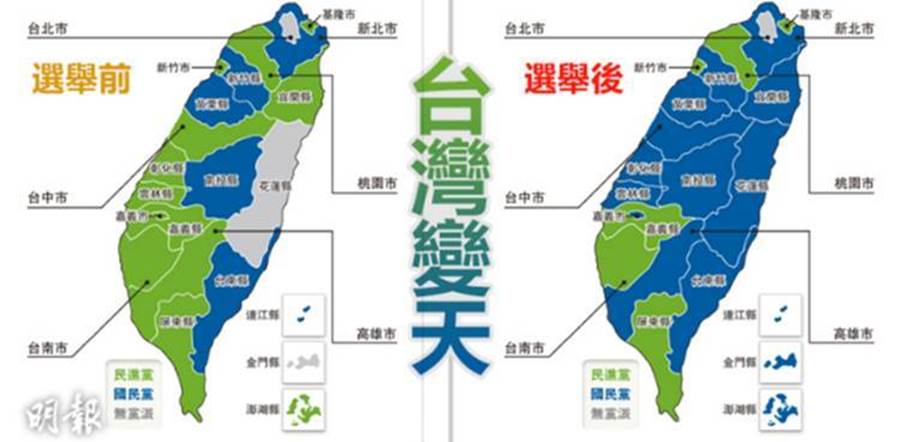

Another acid test for China’s intentions will be clear soon. Under this macro environment, the people of Taiwan made their statement over the weekend. The Taiwan midterm election produced a catastrophic outcome for the ruling pro-independence DPP, leading to President Tsai Ing-wen resigning from the presidency of the DPP yesterday. The pro-independence DPP lost 6 counties out of 21, winning only 6 while the pro-China KMT gained 8 to 14, with one going to the independent candidate Ko Wen-jie.

What statement is this? In our view, it is a statement that the Taiwanese people are not willing to meddle in the US-China confrontation, especially as a US hitman to contain China. By making such a statement the Taiwanese people voted the pro-independence DPP out of the office.

Now some would argue there are other reasons behind KMT’s big win. But the reality is Taiwan Independence is now less likely a flash point between US and China. It follows that China is in less an urgency to develop military capabilities to confront the United States. It follows that China can give up Made-In-China-2015, at least in some degree, to appease the US. This means the operation of falsely promising a suspension of China’s state support for high technology is actually workable. Afterall the US will likely demand verifiable progresses and they can have some.

But we are doubtful that Chinese leadership, under President Xi, is nimble enough to capture this window of opportunity. Unfortunately, China’s intention to challenge US dominance regionally and globally will be laid bare after the development in Taiwan. If China simply pockets this gift from Taiwan, it might provoke the Trump Administration to take a more hawkish stand on China in the coming years.

Local mayor seats before (left) and after (right) the Taiwan mid-term election (Blue=pro-China KMT, Green=pro-independence DPP)

Source: Ming Pao

So under the condition that the summit will not produce any tangible results, what shall we expect of our stock performances?

In my view, stock might go up!

I think the market is gradually digesting the fact that economy in C1Q19 will be very bad. Such digestion has already caused the stock to fall in October. Now if the US-China trade talk falls apart, hopes might arise that China will adopt more progressive stimulus policies in 2019, including tax cuts, push out in critical reforms (like social security) and consumption rebalances.

Under this scenario what stocks should be buy?

l Buy consumer, avoid corporate. Corporation makes rational decisions, consumers don’t. Stimulus will directly benefit consumers, in our view, but corporations will need to cut their jobs in order to stay healthy. Therefore we recommend to long BABA (BABA US, BUY, US$180) and short BIDU (BIDU US, BUY, US$252) or WB (WB US, HOLD, US$65). Our Auto analyst Jason Chen recently cut ratings on auto Internet names like BITA (BITA US, HOLD, US$20.5) and ATHM (ATHM US, HOLD, US$73). The only exception to the consumer story is auto, which we believe will stay weak. Jason recently cut auto financing company Yixin (2858 HK, HOLD, HK$2.6) from BUY to HOLD. Other Advertising names we do not cover include iQiyi, SINA and Focus Media;

l Avoid regulatory headwinds. In order to compete with US on a broader scale, China needs to reform on a wholesale scale. If such hardliner’s logic prevails, we expect headwinds to persist for Education and Online Game companies;

l 58.com is still our favourite safe choice. Small medium businesses are the main advertisers on 58.com. Even if corporations cut their jobs, people still needs to find work. We are not sure if next year’s stimulus will include some relaxation on real estate, but any relaxation will be a boost for WUBA (WUBA US, BUY, US$84). We believe ideology wise the hardliners hold no hard feelings towards real estate. Combating high property price is a priority of reform but such priority cannot be achieved overnight. The magnitude and the multiplier effect of the real estate industry still make it an indispensable tool for adjustments for any practical economic czar;

l We are neutral on Tencent. Tencent is reaping the reward of its investments like Tencent Music but suffers from two shortcomings: (1) online game is disliked by the hardliners. In developed countries online game players are adults. In China they are underaged children. China will converge to the global norm; (2) Weixin Moments is severely lagging behind other social players in algorithm-based content dissemination This, in our view, will hinder Weixin’s potential for further monetization. The logic is simple: Saturation of mobile users has shift the driving force of mobile Internet from content consumers to content producers. Algorithm-based content distribution is far more efficient than the friend-based one. Weixin’s slowness in embracing algorithm-based dissemination is giving BABA an opportunity to counter Weixin’s threat in e-commerce.

Because we are not sure on the outcome of the Argentina summit, we opt not to change our pair trade portfolio. Afterall, politics is politics. We prepare for, but don’t bet on, things we don’t understand.