2018-10-08

Author: Eric (Tianli) Wen, Head of Research

For past Pilgrimage publications, please contact BLRI sales (sales@blue-lotus.cn).

| Stocks mentioned in this email | BABA, 700 HK, JD, NTES, BIDU, TAL, CTRP, ZTO, WUBA, BILI |

Dear all:

Since last time we have proposed a theorem: if the speed of supply chain moving out of China equal to that of China climbing the technology ladder, war can be avoided. If not, bitter end will come in two possible ways: (1) a hot war and (2) a civil unrest in China.

We maintain this view as this week US vice president Mike Pence setting up an uproar in China by delivering a speech that is widely perceived as the replay of Winston Churchill’s “Iron Curtain” speech on March 5, 1946. Some speculated vice president Pence delivered this speech as a warning China after a Chinese warship almost collided with a US warship in the South China Sea. CNN reportedly said the US Pacific Fleet was considering launching a military exercise near the Taiwan Strait in November to put the ball back to president Xi.

That playout sound ominously familiar to the leading of the Battle of Tsushima where Japanese Imperial Fleet ambushed and destroyed the Russian Baltic Fleet in 1905, if I am itching for a prediction.

.jpg)

Source: Google

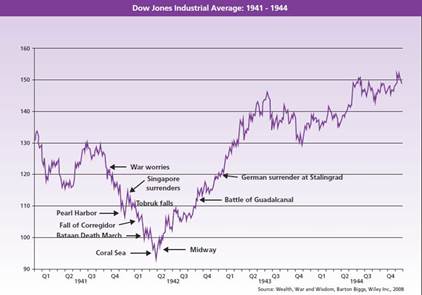

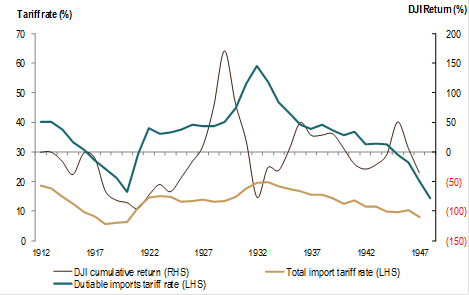

No, we don’t think The Battle of Formosa will happen. Barton Biggs said stock market was very smart at predicting wars. It started falling three months ahead of Pearl Harbour and started rebounding right after Midway (Figure 2). US International Trade Commission said trade war historically didn’t affect US stock performance (Figure 3). In fact it followed the reverse way.

We tabulated these two data and found out what they actually said was: as long as US wins (or appears to be winning), stock goes up. Otherwise, goes down.

Well, that makes a lot of sense. But the question is whether we classify Chinese ADR’s as US stocks or Chinese stocks?

The question must have tortured a few liked-minds of ours lately. My conclusion is that unequivocally, they are still Chinese stocks with cash flow derived from China. But unless Chinese or US government confiscate that stock ownership, investors can still enjoy the ownership of that future cash flow. But that is a big if. If global businesses do withdraw from China, then cash flow of our sector stocks will be affected.

In our view, there is a general disbelief in the Chinese sphere that (1) the Chinese government will be able to handle the New Cold War with the US properly, (2) the reform measures Chinese government are launching amid the trade war (which means China is determined to confront the US in the long run) will be successful, is truly reform-motivated, cannot be better timed, or in a nut shell, is wise. This disbelief resulted in an increase of perceived risk level that is deflating all equities in A- and H-shares. Chinese ADR’s actually fetched better.

Figure 2. Dow Jones Industry Average during WWII

Source: Barton Biggs, Wealth, War and Wisdom

Figure 3 US tariff and inflation adjusted Dow Jones index return

.png)

Source: US Department of Commerce, Bureau of Census, US Int’l Trade Commission

The question is, at what price level has the increased risk been fully priced in? Below we did a what-if analysis of WACC+X. The reason we did this exercise is because we believe that in the long run, the free cash flow impact to our coverage companies will be positive. Our exchange rate assumption has been adjusted to US$1=Rmb6.8. So we might price in another 10% downside from currency depreciation to reach the final reasonable price, if our buck-the-trend optimism justifies. It seems many of our covered stocks have fully priced in WACC+2ppt to WACC+ppt downside risks or more.

Figure 4. Downside assessment of major stocks under coverage

.png)

Figure 4. Downside assessment of major stocks under coverage

.png)

We are still positive on the eventual outcome

The question again is, how can we be sure discount rate is the only parameter impacted? China must beef up tax collection, pollution adherence and IP protection. But how can we be sure these measures are not veiled plundering of private property? China must beef up innovation, But how can we be sure the government will not view anti-trust (maybe another form of plundering) as a necessary means to reach the innovation end? Some of our covered companies will face what we call “race track changes”. After school tutoring (AST) is a classic example. President Xi clearly thinks, correctly in our view, that the current Chinese education system ill prepares Chinese kids to be capable citizens for tomorrow’s society. But how to change? Will new leaders emerge to take over from the old? Or will old leaders reinvent itself to reassume the leading position?

Here is our basic assumptions to the above questions. For those who worry China’s recent reform measure is just veiled form of blackmail of the private sector, the logic disconnect is where will the looted fortunes be stored and how will it be spent? The only safe destinations are US or US influenced domiciles. Then why would Chinese leadership challenge US in the first place? As for what is the proper pace for these measures taken, we do have our doubts. But as we have repeatedly pointed out as early as March, the time window for China is limited. We have to see how things play out.

But now that China has acted promptly, our base case actually has turned optimistic in the long run. We are more positive than we are six and three months ago. We believe the most likely scenario, and the intention of the Chinese government, is to sit out the entire presidential term of Donald J. Trump. This is not because Chinese leadership loves peace. It is partially because (1) it is the only option, given China’s overall strength is not a match with the US in a total confrontation, (2) Chinese military capability, to our understanding, still cannot defeat the US Pacific Fleet twice (one original and one sent for reinforcement) in a regional conflict. It is also because (3) Chinese population, from what we observe, is deeply divided on the necessity about going to such war. further, (4) it is our guesstimate that during the next six years, the advancement of China’s military technology will still not be able to narrow the gap to overthrow (1). The last but not the least, (5) it is also our belief that the transition from collectivism to private property, ushered in 40 years ago by Deng Xiaoping, is deeply rooted and irreversible.

Yes, the underlying assumption of all, is that private property must exist before stock price, or all else are just pipe dreams. All our DCF calculation will belong to nobody.

A war can have three outcomes: winning, losing or truce. We believe the outcome will be a truce. Historically there has been truces in worldwide conflict before. A truce is very difficult to achieve because it requires perfect execution from both sides, or their errors cancelling each other out. Vice president Pence’s weekend speech is such an error, not only because he quoted the Chinese proverbs in the wrong context, but also because he made the Chinese more unified than before.

After a six year stand-off, successors to the presidents will renew the ties of the two countries in less confrontational terms. Both countries grew stronger and better as result. China must prove it is indeed what the US has feared.

What might possibly change the equation is Taiwan Independence which may change (2) above. As for the propaganda about China’s intellectual property theft, I think they are just bullshit.

Is patience a virtue of the Chinese anymore?

Value investing never worked in our sector. For the stock to rebound, one of the two uncertainties must remove (or receive a relief): (1) macro uncertainties, (2) cash flow uncertainties, but there is another one: (3) new liquidity into the system.

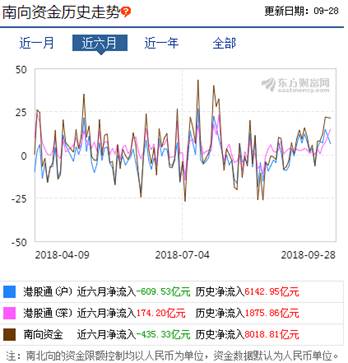

From a liquidity infrastructure perspective right now is the best time ever to own Chinese stocks. In September MSCI raised the market weight of A-share stocks and FTSE-Russell announced it would add A-share to its Emerging Market Index. Under the Hong Kong-Shenzhen-Shanghai-Connect Program, there are now more overseas fund flow into China than there are Chinese fund flow into Hong Kong. How to explain this?

So here is my point. It might be the case the US Conservatives are looking at history from a higher point than Chinese decision makers do. It shouldn’t be a surprise because modern civilization is created by the West. But China’s best response should still be to acknowledge its shortcomings and implementing what the West has demanded, but without publicly admitting so. The former will unite the hearts and the minds of the people both in and outside of China to join the struggle against the enemy. The later will ensure stability. China’s vastness is its greatest assets. It has a lot to share and can be flexible on the terms of the sharing. This opportunity of shared development did not exist for Japan and Germany in WWI and WWII. But to hand out that opportunity, ensure a decent term and prevent any forms of opportunistically vicious behaviour, a united Chinese government must be in presence.

There are still many openings China can do to attract new liquidity into the equation, simple and costless steps to enlist others to help China’s cause. Further opening up the A-share market is one such step China can take. Further leveraging Hong Kong’s status as a mature capital market operator is another. This will make Hong Kong more important in the next decade, in our view. Nurturing a law-abiding civic society is certainly a must-do, but ceding more control from the government to the market is also a must-do. If the collection of new taxes and confiscation of criminal assets are channelled into rural development, low income families and military, then we consider these tightening necessary. If the raising of floor to do business prod Chinese entrepreneurs into innovation instead of endless price wars, then we consider these measures long overdue. If the reform measures in education does allow more diversity of the world to be introduced alongside with the reemphasis on Chinese classics, then we consider these upheavals at least good as a start.

In Ian Morris’s book

Figure 5. Fund flow into China (SH & SZ stock exchange) from Hong Kong

Source: Wind Choice

Figure 6. Fund flow into Hong Kong (HKSE) from China

Source: Wind Choice

Getting used to the new paradigm…But a short term bottom is near

So when we are going to get a rebound, even a short one, is the question often asked.

After the mid-term election, we will be facing an emboldened Trump, which means things will get worse before getting better. However, from the China side, things appears cannot go for the worse. Perception wise Chinese opinions are quickly converging, thanks to vice president Pence’s hawkish remark. We believe when the US and China intentions have been fully digested and agreed, Chinese stocks will form a bottom and so do our ADR’s.

Here are the adjustments investors must go through. The early they go through the faster the rebound.

1. Chinese must adjust to more pain in their daily lives. Chinese must understand the pain of their American counterparts who for years must watch their country filling up with people and behaviours that they did not like, and could do nothing about it (factual description). This pain culminated to the national consensus today and the groundswell of support behind president Trump (factual description). Chinese, on the other hand, had not enough pain in their lives. The corporations and the individuals will take time to reach their national consensus (but quicker than we think, if past is any guide);

2. Chinese ADR investors must adjust their investment expectations. In our sector the last bear market happened after the IPO of Renren (RENN US, NR) in May 2011. After that the we had no meaningful bear markets until now. Even after the spectacular IPO year in 2014 (which brought BABA and JD to the market) did we not had a sustained correction. This is the longest running Chinese ADR bull market to my memory. But things are different now. Buying on the dips will no longer hold true this time. Starting from this year we have adopted the pair trade strategy to contain our investment risks. If US and China get into a hot war, Chinese ADR’s might be delisted and their assets confiscated. Recently IPO’s might be able to buy back their entire float to retreat honourably. Older IPO’s might not be able to afford buying back their stock which has now appreciated many times over. Baidu (BIDU US, BUY, US$283), for example, had went up 76 time since IPO, which means to redeem the original US$109mn IPO proceeds raised BIDU needs to dove out US$8.3bn in cash, or 65% of its net cash balance in C2Q18. We estimate the entire Chinese ADR companies (73 by our count) had raised a total of US$39.7bn from the US investors. Most of these cash still sit in US bank accounts assessible by US government;

3. History of trade wars and hot wars told us stocks in a conflicting country can only go up if this country wins. This means Chinese ADR will go up only if China wins, regardless of where the stock trades. So for our own sake, we too hope China can regain some grounds against the US, either diplomatically or economically. But in the medium term we are not optimistic. We believe any short term rebound, will be short-lived. There is a logic disconnect in the past decade, where China has become so important globally, while its contribution to the world’s wellbeing so limited to low end production. If the goal of Chinese government is to make itself a large sized Japan, even if it means the large sized Japan-of-today, it is still worrisome to some, in my opinion. The future China must be more open than today’s Japan. We are confident on the eventual positive outcome because we believe this notion, while today not widely shared, will be understandable and is easy to achieve by the Chinese population, based on my understanding of this country. This forms the bedrock of our conviction for stay long term positive.

Going forward, the US has made its hands clear but China has not. What will change our view of long term positive, medium term negative and short term positive positions is how Chinese government will reveal its hands in the months to come.