2022-06-08

Blue Lotus

June 2022

Shawn Yang, Managing Director of Blue Lotus Research Institute, was interviewed by CNBC and Bloomberg on recent earnings results of Alibaba, JD and Meituan. Despite impacts of COVID resurgence, we remain positive to JD and Meituan, and neutral to Alibaba.

|

CNBC interview on May 27th

Q:Shawn Yang, he is a managing director at Blue Lotus Capital Advisors and joins us now from Shenzhen. Shawn, can you help us to make sense of this? I understand that the earnings were a beat and investors are very excited. The market is showing double digit percentage gains. But is this rally overdone because those covid lockdowns, all of that wasn't really reflected in the Q1 numbers. So is it something that we haven't even seen yet?

Shawn Yang: I think that basically the rally shows that the market is very optimistic more about the upcoming quarters, especially the second quarter. Both Alibaba and Baidu have already claimed to investors that their second quarter will be even worse than the first quarter because April and May are two really bad months. Whereas in the first quarter, only mid-March have experienced COVID. Some of the impacts are reflected in, for example, the logistic impact to eCommerce. And for advertising, some online advertisers actually stopped their advertising events campaigns.

I think what’s more importantly is that after the second quarter, is 2H22 going to be better with some macro-economy improvement? Or are Chinese consumers still conservative and unwilling to spend? This is going to be a big question mark for the investors.

Q: Ns we look at Alibaba, it's a good gauge of Chinese economy. JD.com also reported its weakest revenue growth ever. But on the back of that, it was a beat and the market rally 8% on the back of its report. Between Alibaba and JD, which do you prefer?

Shawn Yang: We actually have a hold rating to BABA and a buy rating to JD. If you look at the revenue growth, JD is still able to keep roughly about 20% revenue growth this year as we expected. As for BABA, we can see that 1Q22 total rev is ~9% YoY and much slower than JD. If we look at its core eCommerce, we expect it to decline with less than 5% YoY this year. I think what is the most important is that BABA is facing a more competitive environment compared with JD. For example, Douyin is still taking merchants from the verticals of apparel and beauty makeups, which is the two strongest categories from BABA. But for JD, most of its important categories, like electronic devices, home appliances and FMCG, are less impacted by the competition. That's why we prefer JD more than BABA.

Q:Let's take a step back and look at the sector. Still, there are very highly divergent views on China tech investment landscape, coupled with ups and downs of regulation. As early as last month, JP Morgan was still referring to the sector as uninvestable. Do you think the worst is behind the sector for now, or could things get worse before they get any better?

Shawn Yang: As most investors expect, the worst time is over. And more people will be more optimistic. I think currently people are simply trading for expectation. There hasn't been any very credible number to support that argument. There just have been some important meetings to ease the regulation a little bit. But next step what we have to take a closer look is what's the implication for the earnings, including revenue, profits—all those financial numbers for the companies and the whole sector. And more importantly, who will be benefit more. Even though it's a very big wave, but what company will benefit more from that trends? Going forward, probably there'll be some uncertainties for the whole sector, but some companies will outperform others.

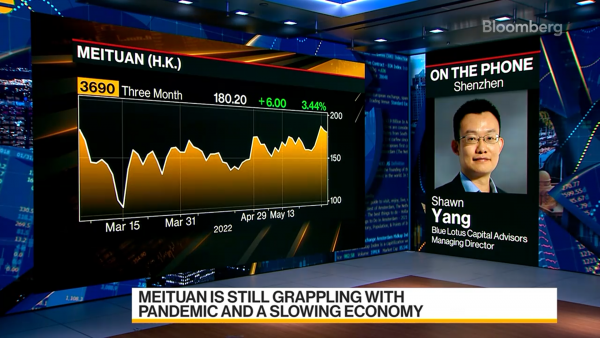

Bloomberg interview on June 3rd

Q:What’s your take away from the number? Is there a sense that there’s a resilience for Meituan despite the difficulties of the COVID lockdowns?

Shawn Yang: If you look at the first quarter numbers, they are still very resilient. Because the COVID starts from late March, if we look at the first quarter results, both the food delivery and in-store increased roughly 15-20% and the total revenue increased by 25 %. Also their margin beat consensus.

I think that investors care more about the second quarter results. What's more important is that is there a recovery trend in June, after the wide lockdown had been partially released? I think at least their financial statement demonstrate that trend. We’ve upgraded Meituan about three months ago and the stock price proved our senses. It's the best-performed stock compared with other large competitors like Alibaba and Tencent, because it has a better competitive landscape and has better offline penetration. So most investors would expect that the COVID impact is only a temporary thing. And the company could continue to deliver stable performance.

Q:There seems to be strength when it comes to the grocery segment. Are you more positive when it comes to Meituan Maicai?

Shawn Yang: Meituan Maicai actually is divided into two parts. One is called Meituan Maicai and the other is called Meituan Youxuan, but all related to grocery. What’s more important is that this year they’re trying to control the cost and improve UE model, because they and PDD, as two top players, have already take more than 90% of the market share. In other words, they are entering into a more mature stage so that they can maintain their market share and continue to improve their UE. That’s why we think their margin could beat.

Q:What does Meituan's results tell you about the broader markets, especially when it comes to those Chinese tech names.

Shawn Yang: There’s a rebound to all the Chinese tech names, but Meituan is one of the best-performed stock. Broadly speaking, people are less concerned about the regulation and they see those tech names entering a more mature stage and improving their margin.