2019-07-18

![]()

Author: Eric (Tianli) Wen, Head of Research

Over the past four weeks I have been vacationing in Seattle, chauffeuring my daughter from one American summer camps to another. Over these weeks I was surprised by the number of occasions I was approached to ask about the protest in Hong Kong, even far more frequent than the most mentioned topic in Chinese media these days, which is the compulsory garbage sorting in 1st tier cities.

The western media misinterpreted the silence about Hong Kong protests in China, just like they misinterpreted Donald Trump. Most Chinese know what’s going on in Hong Kong. To say they don’t must check his or her IQ in this age of Internet. From my observation, Chinese are silent for just two reasons: indifference or anger, or both.

What concerns me is the oppositions might have found an action loop

Because Hong Kong’s judiciary system is still partially British, I am afraid this is a loophole that HK opposition has learned to exploit. At this critical juncture of US-China standoff, Hong Kong factors prominently in China’s arsenals against the US in an event of financial war. As we outlined in the past Pilgrimages, the US right-wing lawmakers’ call to delist Chinese ADR’s and deny China’s access to the global capital market can only work if Hong Kong fails to act as China’s gateway. Chinese RMB is not yet fully convertible and will not so for the foreseeable future.

Over the past few weeks I was approached by our clients and Bloomberg to talk about Alibaba’s (BABA US, BUY, US$200) listing in Hong Kong. We see it as (at least partially) trade war motivated. The question is how much HK’s function as a capital city and China’s gateway is impacted by its legal system and expatriate community. We think it is critical that Chinese government handles the Hong Kong issue carefully. So far we are optimistic this will be the base case but we think the challenges and risks cannot be overlooked.

From 2014 to 2019 the fighter never sleeps

The number of judges with Chinese citizenship in Hong Kong’s judiciary system is zero. If this doesn’t sound abnormal, then consider the judges with foreign citizenship is aplenty. In the 2014 Umbrella Revolution, or the Occupy Movement, 7 police officers were sentenced to 2 years in prison after beating dissident Ken Tsang, who spilled unknown liquid (later found to be urine) atop to the police. Tsang only spent five weeks in jail. The verdict was handed down by a British judge David Dufton. He said the police actions humiliated Hong Kong while the dissident acted out of good faith. As a comparison, police officers who beat Rodney King in 1992 was initially acquitted by the court.

In another incident, an ethnic Indian judge Bina Chainrai sentenced 58-year old policeman Franky Chu for four month in prison for hitting a protest in the neck with a baton when on duty. Both Franky Chu and the seven police officers were tried based on video footages.

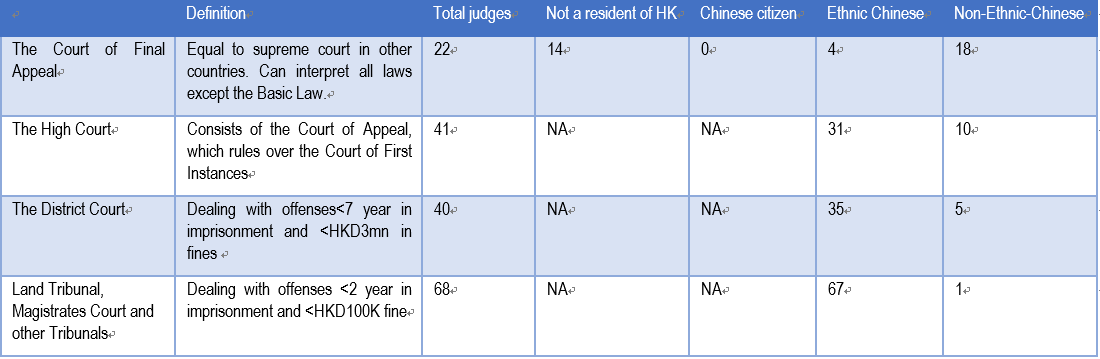

We did some research on the HK judges. Table below shows a count of the HK judges and their nationalities. HK’s Count of Final Appeal is equivalent to the supreme court in other countries. It was chaired by a chief justice, who is an ethnic Chinese, and 3 permanent judges, which has one ethnic Chinese, and 18 non-permanent judges, which none is ethnic Chinese. Among the non-Chinese, 14 are white male and 2 are white female (the only two female). Of the total supreme court judges, 18 resides outside of HK, mostly retired judges from the British Commonwealth and are called overseas judges.

The US supreme court, it has 9 members, of which 3 are women, 1 is Black and 1 is Hispanic, all of whom are US citizens.

Beneath the district court, foreign nationals dwindles dramatically. Mr. Dufton is a district court and Ms. Chainrai is a principal magistrate court judge, both are rarities in their kinds already as the judge workforce of HK underwent localization.

Figure 1 Composition of HK’s judges

Source: https://www.judiciary.hk/en/about_us/judges.html

Apparently the constitution of the judge group has some problems. But how does it happen?

According to the Basic Law (HK’s constitution at the time of the handover), HK judges were recommended by an independent commission and confirmed by the Chief Executive. According to the Basic Law:

4.81: The judicial system previously practiced in Hong Kong shall be maintained except for those changes consequent upon the establishment of the Court of Final Appeal of the Hong Kong Special Administrative Region;

4.88: Judges of the courts of the Hong Kong Special Administrative Region shall be appointed by the Chief Executive on the recommendation of an independent commission composed of local judges, persons from the legal profession and eminent persons from other sectors.

4.90: The Chief Justice of the Court of Final Appeal and the Chief Judge of the High Court of the Hong Kong Special Administrative Region shall be Chinese citizens who are permanent residents of the Region with no right of abode in any foreign country.

Similar to other countries, supreme court judges can only be removed on “inability to discharge” or “misbehavior”. But why HK supreme court need to have 22 judges is beyond my comprehension.

A distorted government structure might destabilize HK

The reason for the current composition of the HK judiciary system is often quoted as a lack of common law talents. At the local court level, the proliferation of local HK judges seems to be obvious. But at the senior level, importation of experienced judges is still necessary.

But I must protest the discrimination against American judges here. If the need for importing judges is to maintain the quality judges in HK, then it follows that diversity must be even more pursued, or it will just leading to a self-interested cliché class seeking to protect its own job. I can see the peril of HK’s distorted government structure. The administrative arm is heavily controlled by; the legislative arm is partially influenced by; but the judiciary arm is not touched by the mainland. HK’s three governing arms have different agendas with mixing identity of bosses they serve.

Now, in my view, the best way to put the judiciary structure to work is through disobediences. It is conceivable that the upresting population and the judiciary interest group might have formed a close loop of “particle accelerator” to gain cementum with each circulation, eventually turning into a nuclear bomb. It is therefore conceivable that there will be more disturbances in HK.

How replaceable HK is depends on whom you ask

In my view, given the difficulties of unrooting the judicial infrastructure in HK, China’s best course of action is to reduce its dependence on the city. But it is easy said than done and requires deep resolve and cunning deftness. We are not convinced the current Chinese government is capable of executing, even though it is gradually realizing the gravity of it.

The reason that the reduction of China’s dependence on HK is difficult is because the outcome doesn’t rest on China’s action alone. It requires the cooperation of the western government which almost for sure is not going to be forthcoming. Maintaining HK’s status quo is beneficial to everyone, including China, until the arrival of US and China standoff.

The biggest benefit HK brings to China is a free capital market recognized and used by the world. HK is especially strong in consumption related stocks, with noticeable strength in Education, Travel, Real Estates, Offline Entertainment, Telecom and Hardware/Electronics. Within these sectors the strengths in Travel, Real Estate, Telecom and Hardware/Electronics are shared and on par with A-share counterparts but strengths in Education and Offline Entertainment (mostly casinos) are unique, reflecting the regulatory grey area of these sectors. HK is also strong in SOE listings, a role difficult to replicate in other locations.

Now, let’s don’t get overhyped. The world needs a gateway to China nonetheless. Those who think a world can exist without China also need to get their IQ checked. But an efficient one and an inefficient one make all the differences. HK’s financial establishment, like its judiciary establishment, is a complex ecosystem. Both can be uprooted, but none can be reformed, externally. Whether China can duplicate HK’s international status in another city, likely Shanghai, largely depends on whether the west approves it to happen. We don’t think it can be done.

If China cannot reproduce another HK, its 2nd best alternative is to wage a proxy war by its surrogates with a goal to safeguard its interests. Its 3rd best option is to launch a tooth-and-nail campaign against the separationists and its sympathizers, which we doubt its worthiness. It is highly likely that China might do all three. From the positive light, the situation in HK will push China to reform its currency with urgency. From a negative side, economic downturn, structural reforms and the trade war make the RMB convertibility full of risks.

We don’t think China will seek to disband HK’s judiciary system by requiring citizenship at the court, even though at this time it is becoming apparent the Basic Law stipulated some 30 years ago has underestimated China’s growth thereafter, leading to the current malaise.

The Basic Law underestimated China’s growth at the time of signing

In commerce we know a contract is not a contract, which means contracts can always be renegotiated, at a cost of course, or it will be only worthy the cost of enforcement. A contract without a recourse will be slavery. I don’t know what the legal profession’s point of view. As a graduate from Chicago and a financial professional, I tend to view every problem as an economic problem. This is certainly not the case for some who simply want to change the world, which in every profession there is.

So it is unfortunate that we might need to renegotiate the HK Basic Law, to which I am not an advocate, but I see no taboo in it either. What I concern about, is the legal professional in HK takes too much onto their shoulders. My 2 cents is that the Chinese negotiating team was duped by the British 29 years ago when the Basic Law was stipulated. Deng Xiaoping probably underestimated, or probably held at disdain, the British’s request to hold HK’s judiciary system intact and let the profession to self-govern itself, answer to nobody, not be elected, have no recourse on the constituents change and self-claim to represent the people. But judgment aside, as an analyst I do see the dilemma here as US China relations turning increasingly confrontational, making stability in HK a prerogative for the Chinese government. So what are Chinese government’s options?

The launch of SSE STAR market will be taking a stab in HK

Today, some of China’s best and best managed technology companies are listed in overseas. We believe that even more important than reducing the reliance on HK in currency convertibility, China needs to build an efficient capital market to nurture its own high tech enterprises so that the sniper kill of Huawei will not be repeated in the future. The world needs China in its manufacturing and consumer markets, but China needs the world in technology.

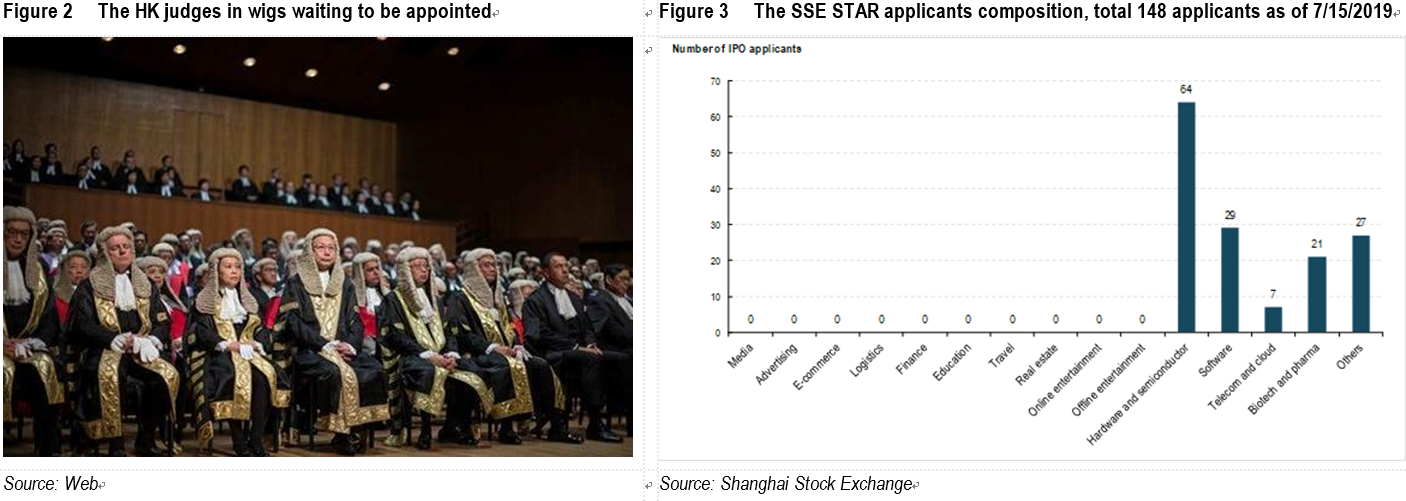

It is with this in mind that China launches the SSE STAR Market, or the Sci-Tech innovAtion boaRd (STAR) Market of the Shanghai Stock Exchange (SSE). To date (July 15), 148 companies have sought listing in SSE STAR, 31 has been approved for listing and will then be registering with CSRC for security offering. Companies in the rooster include: (1) Nasdaq spin off chip designer Montage Technology (MONT US, delisted), (2) Xiaomi and Huawei’s African competitor Transsion Holdings, (3) Xiaomi (1810 HK, BUY, HK$12) and Huawei’s AI image processing supplier Arcsoft; (4) HKSE spin off of medical equipment listco MicroPort’s (853 HK, NR) subsidiary MicroPort Endovascular MedTech, (5) Chinese semiconductor equipment startups Anji Microelectronics and AMEC, (6) Chinese IOT chip designer Espressif, (7) HKSE spin off Kingsoft’s (3888 HK, HOLD, HK$16.7) productivity business WPS, (8) Xiaomi ecosystem partner vacuum cleaner maker Roborock, to name a few. As Figure 3 shows, the composition of SSE STAR has no traditional TMT sectors like advertising, e-commerce and entertainment at all, but rather hard tech sectors like hardware & semiconductor (including medical equipment), software, telecom & cloud, biotech and pharm and others (environmental, material, battery, etc.).

The SSE STAR market will compete with HK’s reformed listing regime for emerging and innovative companies (https://www.hkex.com.hk/News/News-Release/2018/180424news?sc_lang=en).

Through this reform HKSE aligned itself with US listing rules allowing variable voting rights for the company’s shares, as well as waiving the revenue/profit requirement (Financial Eligibility Test) for some high tech areas (biotech, in particular). After the reform a number of mainland biotech firms as well as TMT firms with variable voting rights went public in HKSE. Comparing to SSE STAR’s emphasis on semiconductors and smaller firms, the HKSE’s new regime, which mainly attracts biotech and large firms, seems to be adequately differentiated. But this can easily change. As we know, Xiaomi was rumored to be pressured by the Chinese government to first list and second to dual-list in SSE STAR before it was listed in HKSE. This means the differentiation of the two stock exchanges are not in tacit understanding.

We place confidence in a win-win outcome between China and HK

Despite various undercurrents in both HK and China, we still hold our base case as China and HK to produce a win-win outcome between the two.

Specifically:

HK’s capital markets is still irreplaceable for China in the years to come: An examination in SSE STAR shows it to be adequately differentiated from HKSE’s new regime for emerging and innovative companies. Although SSE STAR tried to lure big cap names like Xiaomi, it was unsuccessful. SSE STAR continues to place requirements on profitability which HKSE’s new regime does not. We believe HKSE’s institution participation and investor sophistication is still way above SSE, which will serve in HKSE’s favour. In the foreseeable future, SSE STAR might still be a market for small cap stocks;

RMB convertibility will be long off: As most would agree.

The trade war’s impact on China’s hard tech will be mixed: Look at Huawei, it was cut off from critical supplier in one week, relieved from the sanction risk in another. Such on-again-off-again change resulting from the US-China technology standoff is detrimental to the company’s R&D effort and will increase the risk for investing in Chinese hard tech companies. We would prefer either the US cut off the supplier altogether so that the Chinese can corner their domestic market, or US liberalize for collaboration so that the Chinese firm can climb the learning curve. Our assessment for STAR SSE to succeed is still below 50%;

China’s strategy of wearing out HK’s legal infrastructure is working: While the non-Chinese judges still occupy the majority at the high court, local judges are taking over in district court and below. Local judges are more divided and generally less confrontational on how to handle relationship with China. With more western education mainland talents joining the legal professional in HK, time is on China’s side. If China pushes for diversifying source of judges, the fragmentation of HK judges will arrive sooner;

HK is important to China’s reforms, although its importance has declined: Traditionally HKSE is good for SOE and Consumer listings. With the new regime HKSE has also attracted China’s best biotech firms. HKSE’s 3rd purpose of existence is legally uncertain areas in the mainland, such as Education and Gambling. HK is useful in attracting foreign capital, thanks to the convertibility of the HK Dollars. This will continue to be important as China prepares for fully convertibility of the RMB. The importance of HK to China has declined, as we can see in most sectors the A-share can already fulfil the function of accurately pricing the assets.